Pradhanmatri Jeevan Jyoti Bima Yojna (Pmjjby)

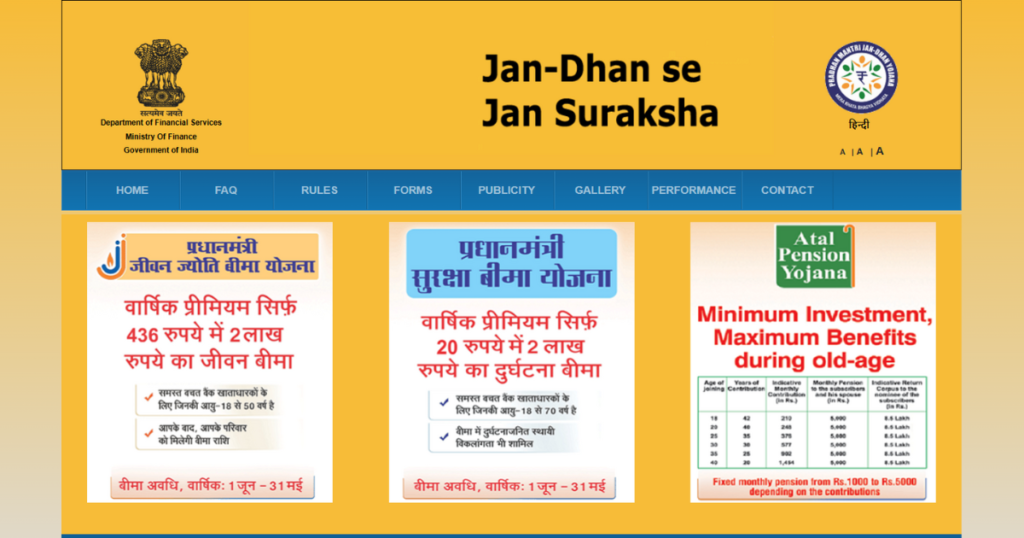

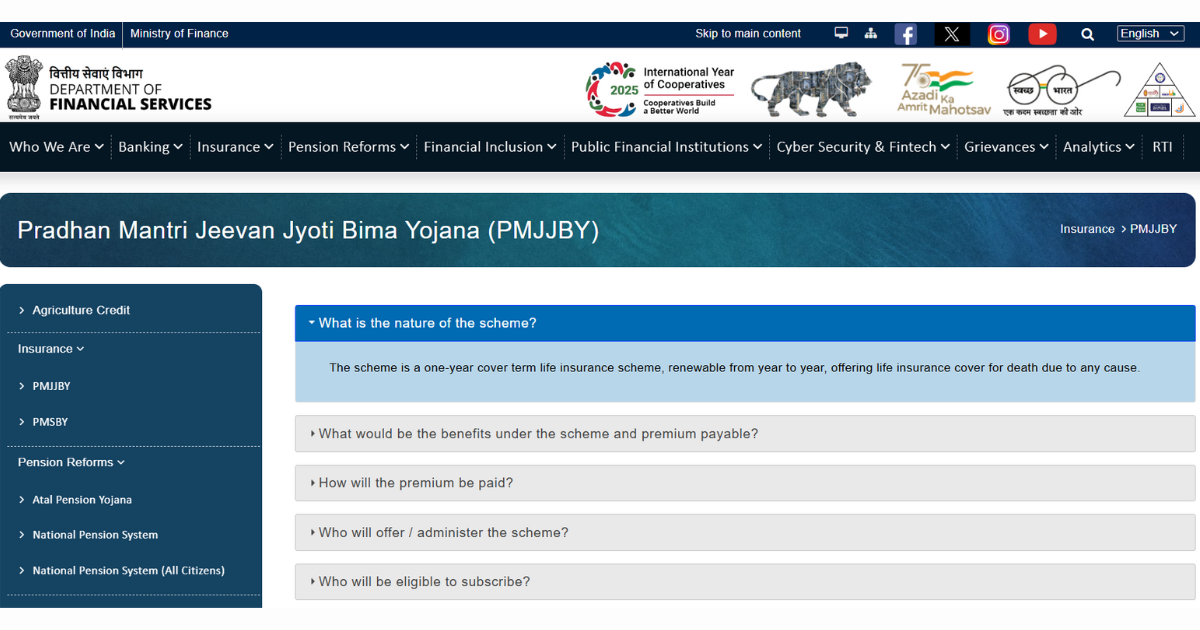

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is an coverage scheme presenting life insurance cowl for demise due to any motive. It is a one-12 months cowl, renewable from yr to 12 months. The scheme is offered with the aid of banks/publish places of work and administered via lifestyle insurance companies. All individuals who are account holders of taking part in banks/ submit offices within the age institution of 18 to 50 years are entitled to enroll in.

Benefits of PMJJBY

- PMJJBY gives one year term lifestyle cover of ₹ 2.00 Lakh to all of the subscribers in the age organization of 18-50 years.

- It covers dying because of any purpose.

- Premium payable is ₹ 436/- in keeping with annum consistent with subscriber, to be auto debited from the subscriber’s bank/submit office account.

Eligibility of Pmjjby

- The age of the applicant has to be between 18 to 50 Years.

- The applicant needs to preserve a character financial institution / publish a workplace account.

Policy Period: From 1st June to 31 May of the following year.

Pmjjby Application Process

Step 01: Download and take print of the “CONSENT-CUM-DECLARATION FORM” given within the hyperlink under: https://www.Jansuraksha.Gov.In/Files/PMJJBY/English/ApplicationForm.Pdf#zoom=250

Step 02: Duly fill and signal the utility form, attach the self-attested copies of the required files, and publish the case to the accepted legit of the Bank / Post Office. The legitimate will return you the “ACKNOWLEDGEMENT SLIP CUM CERTIFICATE OF INSURANCE”.The scheme will be a one year cowl,Pmjjby renewable from yr to 12 months, Insurance Scheme imparting life cover for loss of life due to any reason.

- All savings bank account holders within the age 18 to 50 years in collaborating banks could be entitled to enroll in.

- Subscriber will get insurance cowl of Rs. 200000/- on receipt of top rate with the aid of Insurance Company.

- A 30 Days lien clause may be imposed in PMJJBY scheme wherein the declare cases during the primary 30 days from the date of enrollment will not be paid. However deaths due to accidents would be exempted from the lien clause.

- The premium of Rs 436/- might be deducted from the account holder’s savings financial institution account thru ‘automobile debit’ facility in a single installment, as according to the option given, Pmjjby on or before 31st May of every annual coverage length beneath the scheme situation to availability of the fund inside the Bank’s account.

- On loss of life due to any purpose of the subscriber, registered nominee might be eligible to get Rs 200000/- in his/her saving account.

Following top class will be debited from the account depending upon the month of becoming a member of the scheme.

| Bifurcation ofpremium collected from Customers | Enrolmentduring month of June, July & August | Enrolmentduring Sept, Oct & Nov | EnrolmentDuring Dec, Jan & Feb | EnrolmentDuring March, April & May |

| Total premiumcollected | Rs.436/- | Rs.342/- | Rs.228/- | Rs.114/- |

Termination of Assurance: The guarantee at the life of the member shall terminate on any of the subsequent activities and no gain will be payable under the subsequent scenarios.Pmjjby On achieving age fifty five years (age nearest birthday) problem to annual renewal as much as that date (access, however, will not be feasible beyond the age of fifty years).

- Closure of account with the Bank or insufficiency of stability within the SB account for renewal to preserve the insurance in force.

- In the case of a couple of coverages beneath the scheme, coverage cowl can be restricted to ₹ 2 Lac and the premium shall be at risk of being forfeited.

- The assurances granted under the scheme are difficult to an initial lien of 30 days. No claim is admissible for deaths for the duration of the primary 30 days from the date of commencement of chance. Pmjjby However the identical isn’t applicable if the cause of demise is due to a coincidence. No lien is relevant on next renewals.

Risk Coverage: Risk insurance beneath this scheme is for ₹2 lakh in case of demise of the insured, Pmjjby because of any reason.

- Risk cowl will begin 30 days after fresh enrolment.

- Claims paperwork to be submitted to the concerned bank department within 30 days from the date of dying.

Scope of insurance: All savings financial institution account holders within the age 18 to 50 years in participating banks will be entitled to enroll in. In case of multiple saving bank accounts held with the aid of a person in one or special banks, the character would be eligible to join the scheme through one savings financial institution account only.Pmjjby Aadhar will be the primary KYC for the bank account.

Enrolment period: Initially on release for the quilt duration 1st June 2015 to thirty first May 2016, subscribers might be required to sign up and give their auto-debit consent by 31st May 2015. Late enrollment for potential cover may be feasible as much as 31st August 2015, which may be extended by Govt. Pmjjby of India for every other three months, i.E. As much as 30th of November, 2015. Those becoming a member of finally can be able to accomplish that with a fee of complete annual top class for prospective cover, with submission of a self-certificates of suitable fitness within the prescribed proforma.

Enrolment Modality: The cover shall be for the only year duration stretching from 1st June to 31 May for which option to join / pay through auto-debit from the unique financial savings bank account on the prescribed paperwork will be required to take delivery of via thirty first May of each year, Pmjjby with the exception as above for the preliminary yr. Delayed enrollment with a price of complete annual top rate for potential cover may be possible with submission of a self certificate of suitable health.

FAQs

Is there any time limit to assert PMJJBY?

No declaration shall be payable in case of loss of life taking place inside 30 days from the date of joining/rejoining the coverage, besides in case of demise due to accident.

Is PMJJBY cowl herbal dying?

Does the PMJJBY cowl demise as a result of natural calamities inclusive of earthquake, flood and other convulsions of nature? What approximately insurance from suicide / murder? All those activities are covered as PMJJBY covers demise due to any motive.

What is the PMJJBY 436 scheme?

The scheme is imparting an existence coverage cowl of Rs. 2.00 lakh for dying because of any reason and the top rate has to be Rs. 436/- consistent with annum per member. Pmjjby’s top rate can be deducted from the account holder’s Saving financial institution account via ‘auto debit’ facility and due on thirty first May every year.

Read More: CISCE Org Result | E-Shikshakosh App | Talathi Result

0